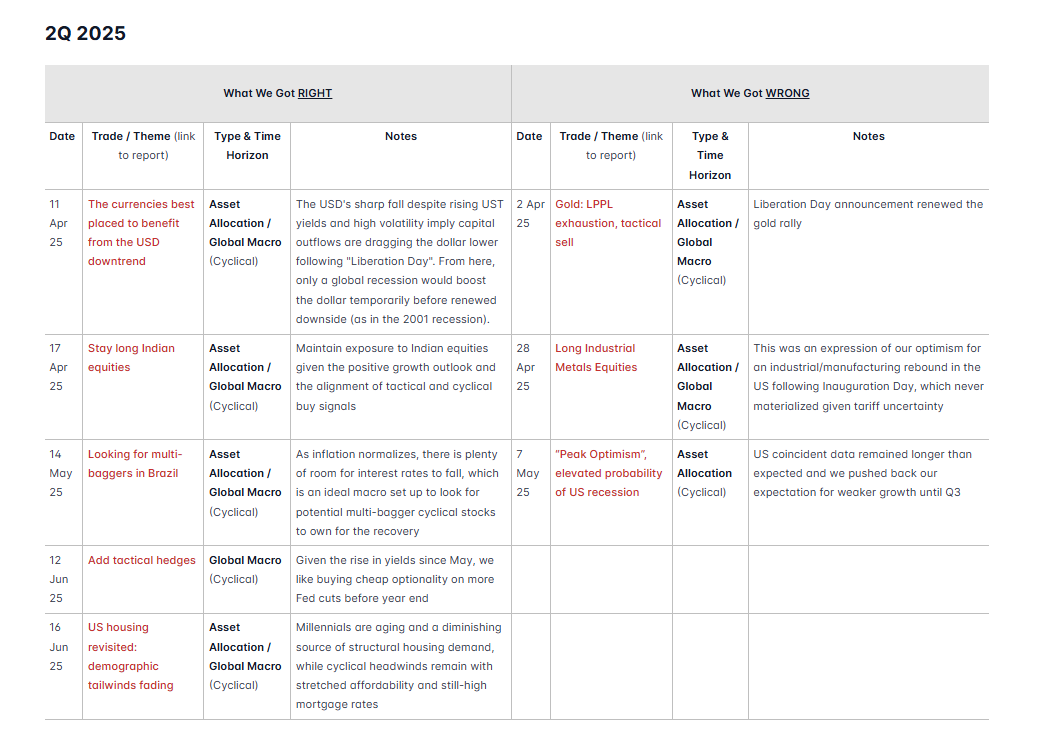

What We Got Right and Wrong (2Q25)

Monthly Wrap, October 2025

Variant Perception, Made Repeatable.

Rigorous investment research grounded in auditable quantitative models. No black boxes, no guru calls.

VP Monthly Flagship Reports

Leading indicators point to “risk-on” cyclical outlook - Macro Snapshot (Sep 2)

Risk of a tactical wobble (weak seasonality, stretched CTA exposure) does not take away from bigger picture: cyclical macro backdrop is improving.

Q3 US growth scare fading, global liquidity rising, and most central banks easing in sync.

We would look to start shifting away from our balanced allocation, preferring equities over fixed income.

We are not blind to high valuations in US indices, but we see pockets of relative value in energy and healthcare sectors as well as select emerging markets. Within fixed income, we still prefer TIPS vs nominal bonds.

Growth steady, inflation risks known, fade policy divergence - Sep. G3 LEI Watch (Sep 11)

US: Housing and labor markets are in slow motion deterioration, but consumption remains resilient, while there are signs of manufacturing green shoots.

China: LEIs are still recovering, and excess liquidity will help equities more than the real economy. Deflationary spill over to other economies looks set to persist.

Eurozone: Markets are pricing 3 Fed cuts in 2026 vs 0 cuts for the ECB. This seems too divergent given the relative growth/inflation outlook.

Supportive growth and liquidity - Sep. EM/DM LEI Watch (Sep 18)

Tailwinds are intact for risk assets from growth, policy and liquidity, and our liquidity-driven regime model still favors EM assets over DM.

Local conditions are starting to matter again as we are seeing divergent leading indicator outlooks within different DM and EM economies.

We are adding short CNHINR based on an LPPL sell signal and the strong cyclical backdrop in India.

What We Got Right and Wrong (2Q25)

Most Read Notes

Buy the rumor, sell the fact into Fed + global macro updates (Sep 12)

We are taking profits on our long SOFR, while retaining a long USD bias into next week.

Add long USDKRW as our preferred long USD exposure alongside short EURUSD.

Close our short CNHKRW for flat and stop out of short AUDUSD.

Lessons from previous “no recession” Fed cuts (1984, 1995, 2024) (Sep 16)

Asset price behavior after the first Fed cut depends heavily on if a recession materializes or not.

Today, our leading indicators do not foresee a recession, which means the most comparable analogs are the “no recession” Fed cuts in 1984, 1995, and 2024.

The takeaway for today is to expect further gains for equities, a rebound in the dollar, and limited downside for bond yields.

US Small Caps: From UW to neutral on macro tailwinds (Sep 23)

We are reversing our long-held bias against US small caps and returning to a neutral outlook.

Periods of synchronized global central bank easing have historically led to a more reflationary environment, resulting in small cap outperformance.

Macro tailwinds and inflows are likely to be meaningful drivers of small cap outperformance, but the structural quality problems remain.