What We Got Right and Wrong (4Q25) - Weekly Wrap

Our Blog Is Moving!

We’re migrating our newsletter to our new website. It won’t affect you in any way — you will instead start to receive the newsletter from info@variantperception.com.

If you’d prefer not to continue, you can opt out at any time here.

Improving earnings estimate revisions are a cyclical tailwind for the equity rally to broaden out.

What We Got Right and Wrong (4Q25) | Watch

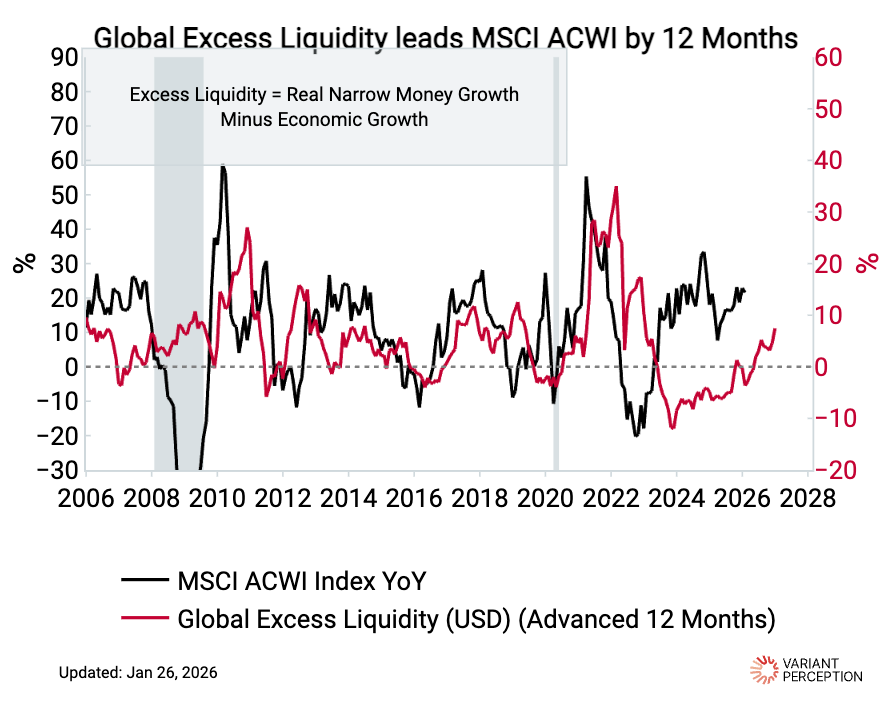

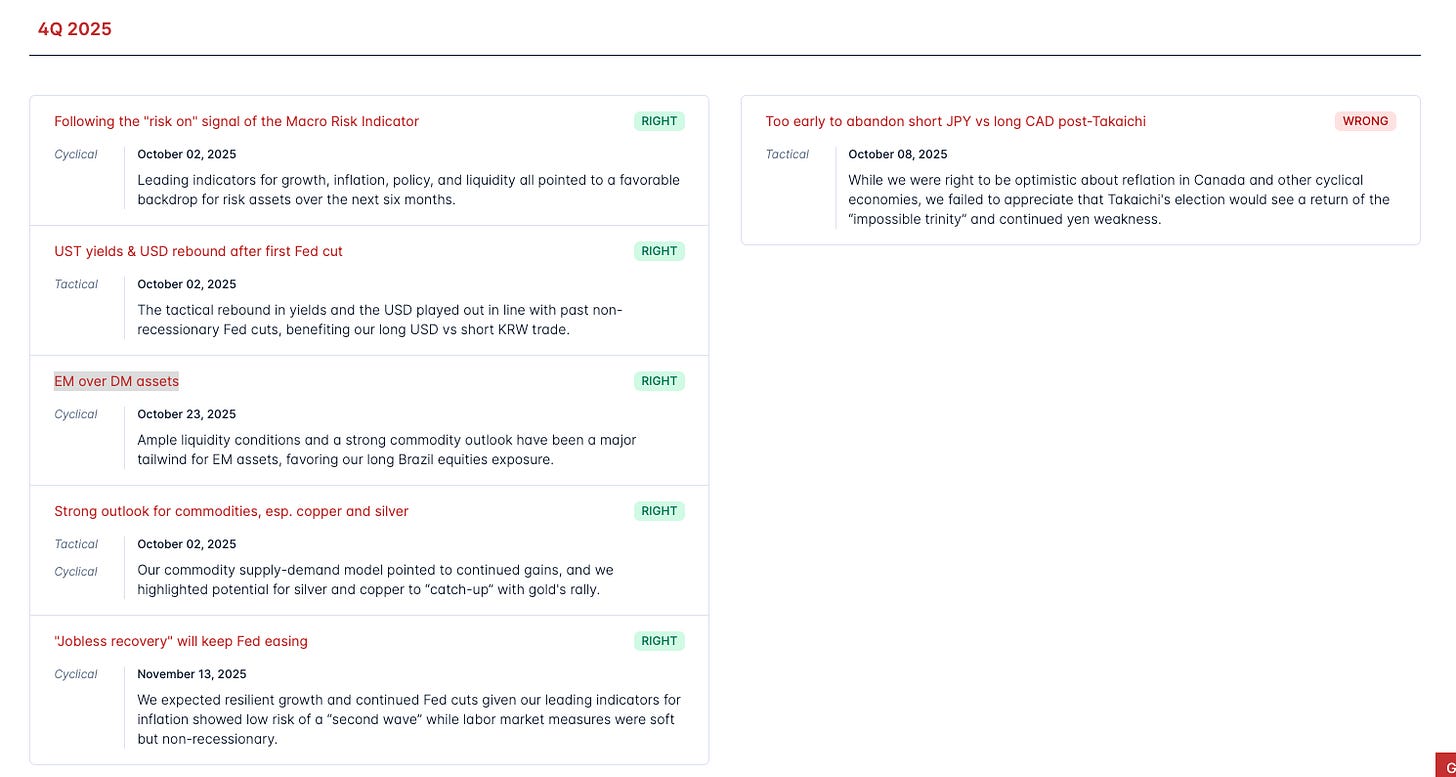

RIGHT: Staying anchored to the Macro Risk Indicator and the jobless-recovery framework proved correct, allowing us to remain risk-on through Q4 despite labor and housing concerns. EM over DM (especially Brazil), a tactical rebound in yields, selective FX cross trades, and a constructive commodities bias all broadly played out.

WRONG: We didn’t appreciate the implications of the Takaichi election result in Japan for the JPY and JGBs, so exited our long CADJPY too early.

Nice honest retrospective. The point about exiting CADJPY too early because of underappreciating political implications is instruc tive, shows how even solid macro frameworks can miss regime-change events that don't fit neatly into the usual leading indicators. I've found that election outcomes tend to create these gaps between fundamental analysis and market movemnts more often than people admit.