Which Rate Cuts Will Stick? - VP June EM/DM Leading Indicator Watch

This post is an excerpt from our June 20, 2024 Leading Indicator Watch report to VP clients. The full length, original report can be viewed here.

Full report summary

New Ideas: Long Mexico bonds (yields lower)

Update: SNB cuts=> long EURCHF, Canada credit stress =>long AUDCAD, more dovish BoE => SONIA vs SOFR convergence (SFRZ4Z5 vs SFIZ4Z5)

UK: Service inflation to keep falling => BoE more dovish

Switzerland: SNB cuts again, inflation/growth still weak => long EURCHF

Canada: Same story of credit stress + weak inflation => long AUDCAD

Japan: FX hedging costs still too high, capping JGB yields

Mexico: Election over + inflation under control => long bonds

Brazil: BCB on pause, BRL pressures make equities a bumpy ride

India: Growth strong + inflation tame, election causing outflows

Indonesia: Fundamentals solid despite fiscal concern, long IDR LPPL signal

UK: Service inflation to keep falling => BoE more dovish

The ONS hospitality price intentions survey has dropped again, showing that UK services inflation is set to fall further.

This favors trades that benefit from a more dovish BoE such as our SONIA vs SOFR Dec 24/25 convergence trade from last week. As we showed on page 2, our central bank models also now see the BoE in an easing regime.

Our overall UK inflation leading indicator has bottomed recently, but the 6-month forward point estimate is only at 2.4% YoY, which is not enough to force the BoE away from their desire to start cuts.

The BoE held rates at 5.25% today, with a continued 7-2 hold vs cut split in the MPC, but the key shift is the messaging that the decision was “finely balanced”.

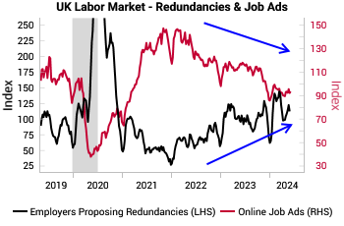

The UK labor market data also looks relatively benign, with a gentle uptrend in redundancy announcements and a gentle downtrend in job ads.

STIR markets are likely to be cleaner expressions of the UK services inflation downside thesis than the GBP. GBP remains the bullish G10 outlier on our medium-term FX edge models, with the UK’s capital scarcity providing a buffer to the GBP.

It is notable that GBP breadth vs G10 has been very strong YTD, showing broad-based GBP appreciation pressures.

Mexico: election in the rear view + inflation under control => long bonds

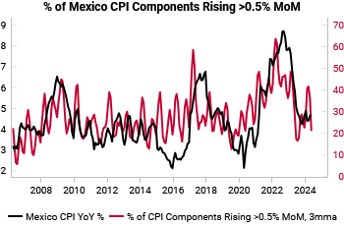

The June election is behind us and our Mexico inflation leading indicator remains muted, suggesting now is the time to get long Mexican bonds.

The point estimate of our Mexico inflation LEI is a modest 4.4%…

and breadth continues to improve, with only ~20% of CPI components having increased >0.5% MoM.

As laid out in our February thematic report, LatAm Elections tend to see large risk premiums ex-ante, which are resolved after the results.

At present, elevated fears surrounding president elect Sheinbaum’s political agenda have caused 10y yields to spike above 10%. It is important to note that Sheinbaum’s Morena party do NOT have the supermajority across both houses of Congress that would allow them to force through changes to the Mexican constitution. They fell short by 4 seats in the Senate.

Our Banxico Easing Regime model is now active, indicative that based on current market and macro data, Banxico would historically be cutting rates.

Real and nominal 10y yields are also elevated versus their own history and relative to US yields, creating a set up for a duration rally.

India: growth outlook remains strong, inflation tame, election causing foreign outflows

The Indian growth outlook is strong while the inflation outlook remains stable. We retain our short CNHINR bias despite recent political volatility.

The inability of Modi’s Bharatiya Janata Party to gain a majority in the recent election has led to foreign outflows. The concern stems around Modi’s ability to rule with a coalition government, which he has never faced during his tenure as president or prior 13 years governing the state of Gujarat.

Nonetheless, the inflation outlook remains in check. Our India inflation leading indicator continues to roll over, driven by suppressed M2 growth (see right pane on portal chart for input details).

Inflation breadth also remains strong, with only 20% of CPI components rising >0.5% MoM.

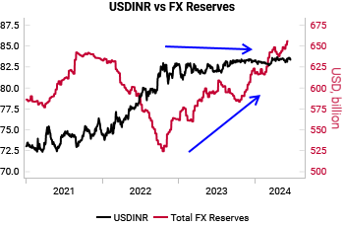

Since 2022, India has steadily accumulated FX reserves. This gives the Indian government plenty of room to step in and support the currency should depreciation pressures gain momentum.

To read the rest of the report, contact us here.