Fundamental gold buy signal triggered

On a 6-month+ outlook, we stick with a risk-off asset allocation while cyclical LEIs are negative and our US Recession Signal remains active. We highlighted potential portfolio hedges for VP clients as the US recession unfolds and policymaker panic is absent. The below is an excerpt from our Jan 10th report.

We mostly avoided gold through 2022 as cyclical headwinds were strong (surging real yields) and tactical tools pointed to a negative trend for most of the year. Now cyclical conditions are more favorable for gold and tactical headwinds have cleared: gold is an attractive recession hedge.

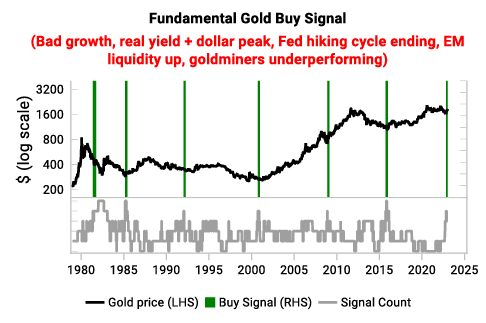

Our fundamental gold signal triggered in mid-Dec 2022. This signal has historically flagged the start of a bullish gold regime.

The intuition behind our fundamental signal: gold bull markets can start when the business cycle is turning down in earnest and real yields peak with the dollar. Rising EM liquidity leads gold demand from China and India. And typically when the business cycle turns lower, this coincides with goldminer underperformance vs S&P 500.

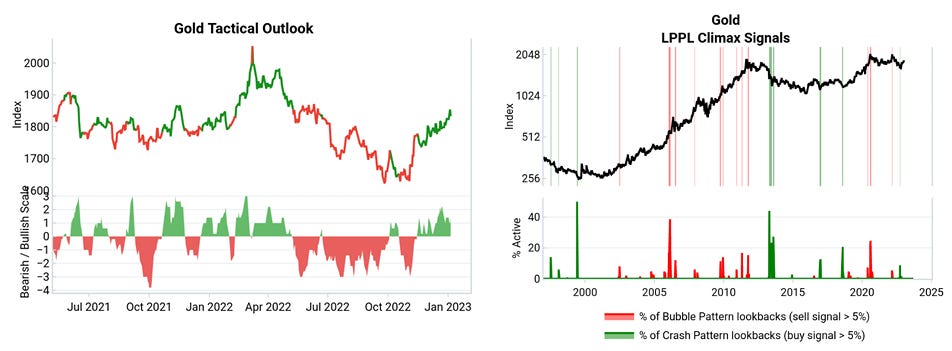

Gold tactical indicators confirm headwinds are clearing. November 2022 saw a clear trend reversal, confirmed by our tactical model (flip from red to green bars in left-hand chart). This coincided with an LPPL crash climax for gold.

Our fast money measure shows speculative activity has returned to neutral, and there is still plenty of room for more inflows.

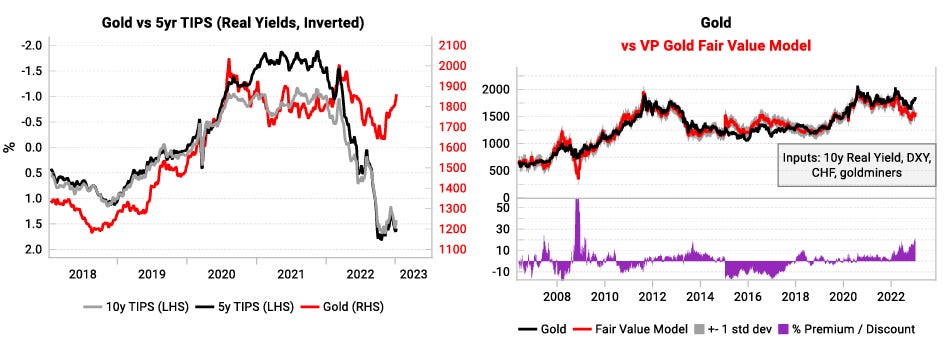

The key bear case is that USD gold prices have been defying surging real yields left (using break evens, left chart below) and could close the gap lower. This has also kept gold trading above our fair value through all of 2022 (right chart below). However given the rollover of our US inflation and growth LEIs, we suspect real yields have peaked. At the margin this removes a headwind for gold.

On balance the tactical, cyclical and structural set up for gold is compelling. In an Age of Scarcity, we expect the politicization of credit, inflationary government spending and elevated energy prices to support real assets. Financial repression is likely to continue in order to finance a capex supercycle.

Get the full picture at variantperception.com

Not quite yet, perhaps........

https://www.mcoscillator.com/learning_center/weekly_chart/golds_price_oscillator/

Very interesting read, thanks for releasing it.