The Age of Scarcity Part 2: The end of the age of abundance

We are exiting the age of abundance defined by cheap credit, cheap energy and cheap labor: profit and cash flow are sexy again. This is the 2nd part of our 3-part series based on the insights from our “Age of Scarcity” thematic report sent to VP clients in November 2022. See the 1st part here.

By the end of the 1970s, stagflation and social conflict left governments with limited policy choices. Deficit spending had only temporarily sustained the “golden period” of the post-war years.

Deregulation and “depoliticizing” the role of the state in allocating resources became the only solution.

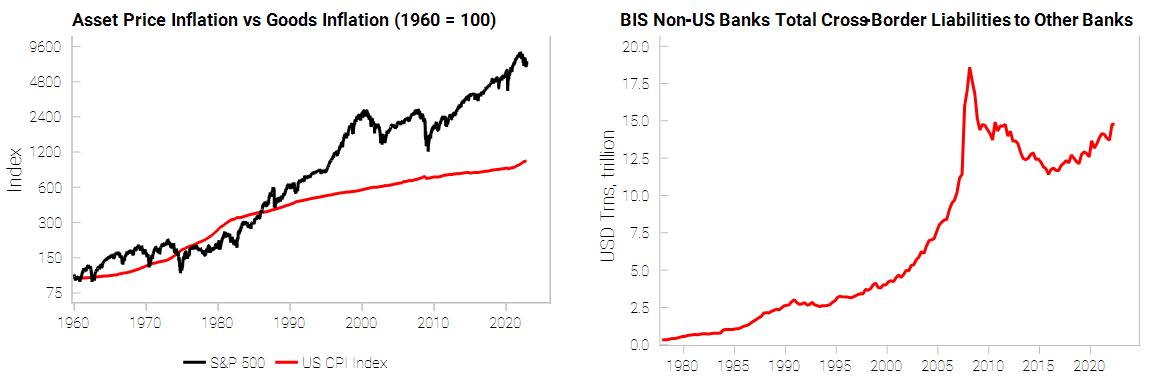

Rapid deregulation of finance helped to drive credit booms that shifted the inflationary mix towards asset price inflation and away from wages and goods inflation.

The end of Bretton Woods and easing of capital controls enabled new sources of credit, leading to the rise of the Eurodollar market, where non-US banks issued USD-denominated credit instruments (away from the control of the Fed).

The breaking of the OPEC cartel and the defeat of the labor movement incentivized private sector investment and reduced the power of labor to bargain for wages.

The formation of deflationary political coalitions (homeowners + business + wealthy) helped to sustain the deregulated financial system that have propped up the profit share of GDP vs labor.

Financial profits vs non-financial profits peaked pre-GFC and are still trending lower. We view financial profit cycles as a proxy for speculative activities reflecting Minsky’s famous hedge vs speculative vs Ponzi financing:

Hedge: expected income flows sufficient to meet principal and interest payments

Speculative: near-term expected income flows only sufficient to pay interest

Ponzi: expected income flows not even sufficient to pay interest, hence, funds would have to be borrowed merely to pay interest.

Today, Ponzi and speculative financing are being exposed again as credit availability tightens.

Investors and companies need to adapt to an environment of scarcer credit necessitating a shift back towards “hedge” financing. The chart below from Sequoia Capital echoes this message: “Cheap capital is not coming to the rescue”.

Growth at all costs will continue to be punished. Profitability and positive cash flows are sexy again.

The ability to finance growth using retained profits will be a big advantage to surviving an extended down-cycle.

Expect more merger activity in the age of scarcity, in particular vertical mergers, as companies attempt to preserve margins by acquiring suppliers.

“Vertical mergers provide acquiring firms with ownership and control over adjacent stages of production… the wealth effect is significantly larger when compared with that for diversifying mergers.”

Source: On the Patterns and Wealth Effects of Vertical Mergers, Fan & Goyal (2006)

Get the full picture at variantperception.com