The US consumer won't stop the reversal of the bullwhip effect

Our US Recession Signal has NOT fully triggered yet, but underlying recession risks are picking up as the bullwhip effect reversal plays out (see here). The below is an excerpt from our Nov 3rd report to VP clients.

We expect a protracted contraction in manufacturing activity. October ISM manufacturing held up above the 50 level (50.2). But new orders vs inventories ratio is below the critical level of 1, pointing to an imminent contraction of manufacturing activity (left-hand chart).

Long-leading indicators flag a protracted downturn (right-hand chart). Manufacturers are working through an inventory glut with falling goods spending.

Many are turning to price discounting, which will amplify margin pressure: “Capacity has increased over the last two years due to high orders of consumer goods and appliances, so now we’re trying promotions to get our orders up to where we can use all our capacity.” [ISM report: Electrical Equipment, Appliances & Components]

Economic stress is building across the supply chain. Wholesalers and retailers are facing record high inventory/sales spread.

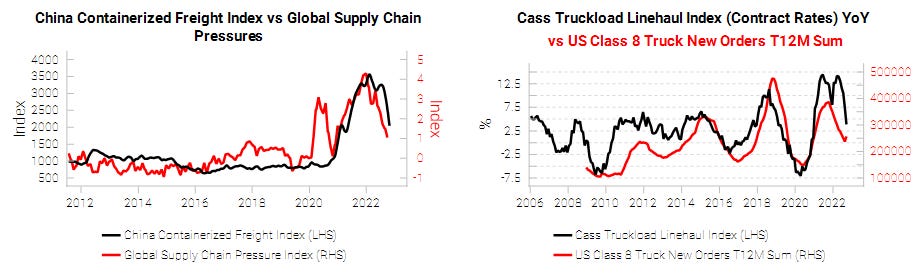

And transportation activity is slowing quickly. Freight rates have fallen sharply (left-hand chart). And trucking rates are falling in line with new truck orders (right-hand chart).

Trucking capacity grew rapidly in October according to the Logistics Managers Index (LMI) (link): “Even during the freight recession of 2019 we did not observe capacity coming online this quickly”.

It is very unlikely the US consumer can arrest the reversal of these bullwhip effects. There seems to be a disconnect between resilient consumer commentary vs weak leading indicators.

Consumer resilience is a key theme across banks and payments company transcripts: “The headline is that consumer spending remained resilient and cross-border travel continues to recover” (Mastercard)

“You're seeing a mitigation of the rate of growth, not a slowdown. Not negative growth.” (Bank of America).

High-frequency data confirms this narrative (chart below). Transaction data is still above the pre-pandemic baseline, but has been plateauing for the past 18 months.

In real terms, retail sales are already negative. And leading indicators suggest further pain for the US consumer.

The surge in rent, energy and medical care costs should lead retail sales lower (left-hand chart). Wage growth is no longer rising quickly as quit rates start to fall. And credit conditions are deteriorating quickly (right-hand chart).

Very weak consumer confidence suggests unemployment should start to pick up.

Overall, our consumer leading indicators flag more hard data stress to come.

Get the full picture at variantperception.com