The VP Crowding Score In Action

The "VP Crowding Score” quantifies a stock's popularity, factoring in diverse investor behaviors to highlight potential vulnerabilities or opportunities resulting from herd mentality.

Proving Empirically Crowding Matters

We laid out the inputs into our crowding score in a previous blog post. To test for empirical effectiveness, we had 3 criteria:

Quadratic Beta: Unlike the linear relationship that the regular beta measures, the quadratic beta assesses a stock's reaction to market volatility. A positive value signifies resilience during market turbulence, whereas a negative one denotes vulnerability. Typically, less-crowded stocks possess higher quadratic beta.

Volatility Differential: This measures the gap between a stock’s projected downside volatility over a set period and its recent downside volatility. Crowded stocks tend to exhibit a notable, larger volatility differential due to their dampened positive responses to good news and heightened negative responses to adverse information.

Reaction to Earnings Surprises: Post-earnings announcements, crowded stocks generally experience less positive returns on positive surprises and more considerable negative returns on negative surprises relative to uncrowded stocks.

The composite of these metrics forms the criteria against which we gauge the efficacy of the VP Crowding Score.

Case Studies: VP Crowding Score Applied

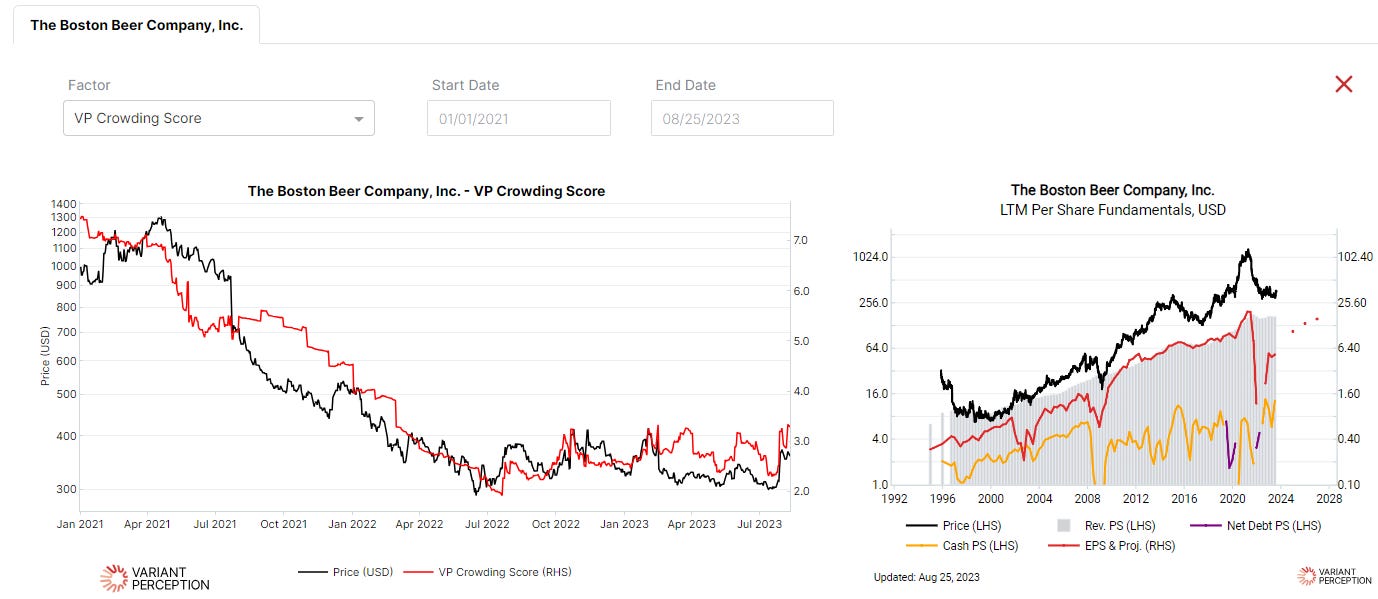

Beverages:

Boston Beer Company: Flagged as uncrowded for the past year. Towards the end of July, it posted solid earnings, and its return soared by 18% since the earnings.

Constellation Brands: Classified as crowded, in the top decile of overcrowded names. Despite a good earnings report at the end of June, its stock only grew by 4%.

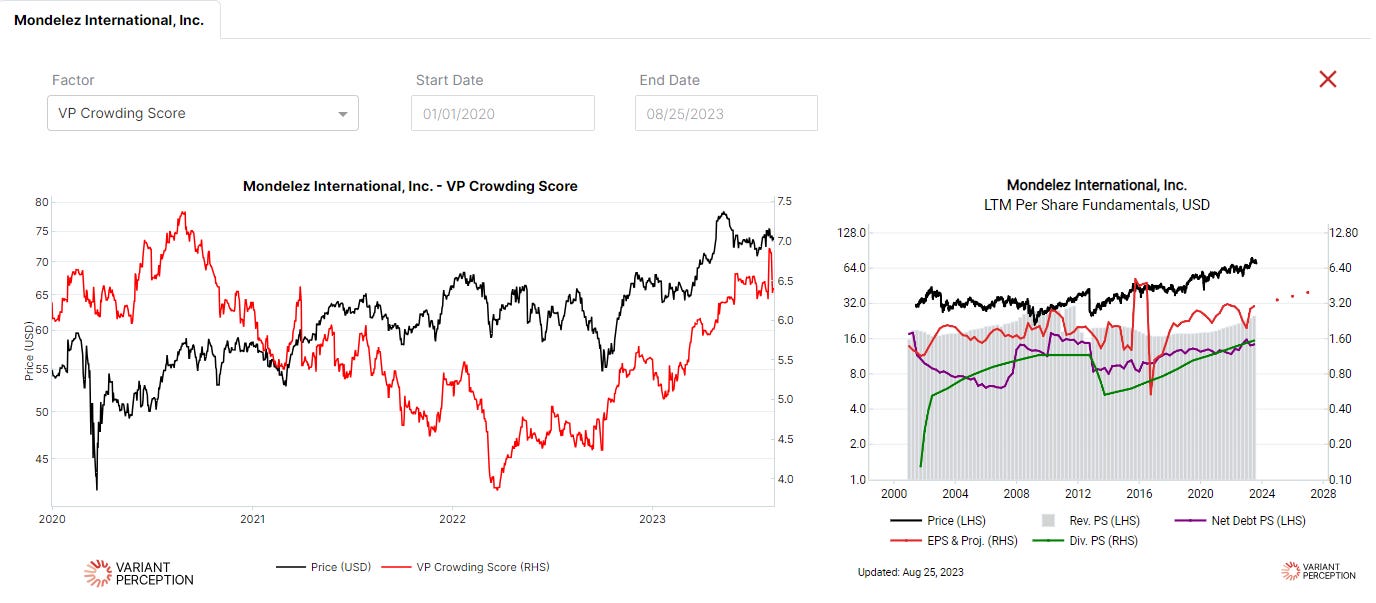

Food Companies:

Tyson Foods: Classified as uncrowded. Despite recent negative earnings, the stock is up over 5% in the past month.

Mondelez: Classified as crowded. After a decent earnings report, the company's stock dropped by about 5%.

We can see that crowded names typically have muted responses to positive news due to their already crowded status. A slight hint of negative information might cause a rush for exits.

While we are not the first to attempt the creation of a crowding score, we have tried to design our score from first principles to behave intuitively. A key feature of our score is that it does not simply reflect price momentum, which is how many typical crowding scores tend to behave.

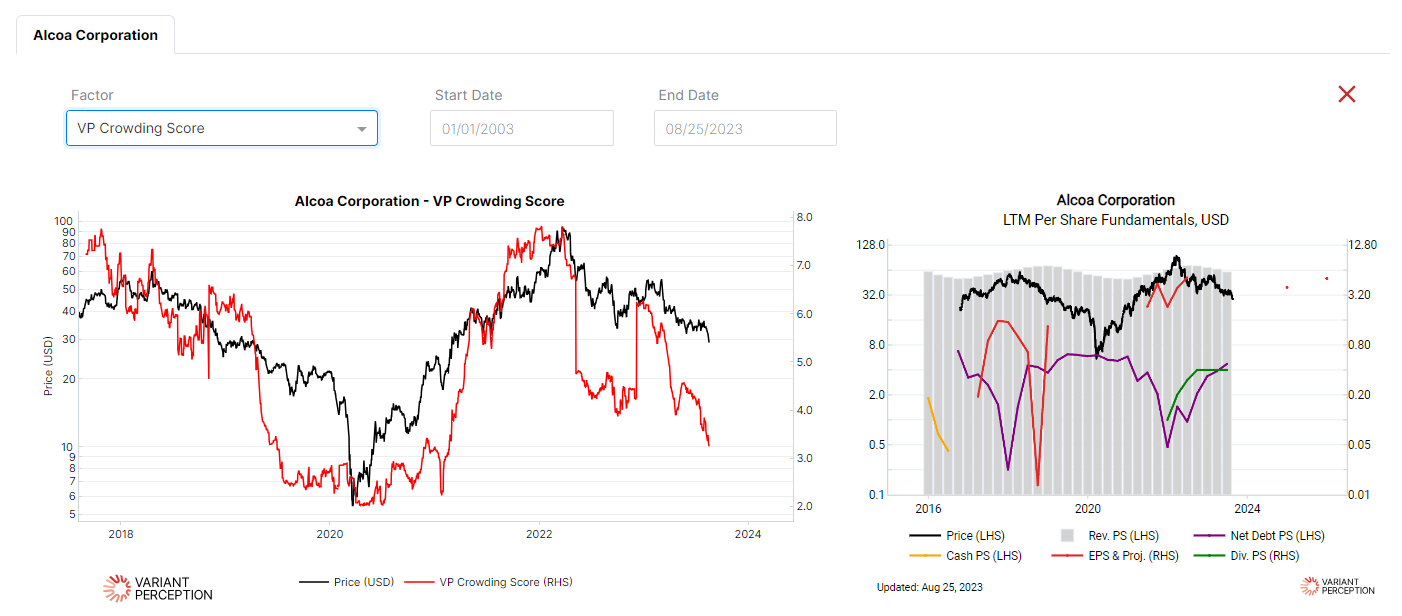

Case in point: Alcoa in 2019-2021 was a great example of the effectiveness of our crowding score and its low correlation to price momentum.

Going into Covid, the narrative was that the company was at high likelihood of bankruptcy. It was not too surprising that the name was very uncrowded and highly hated.

You can see from the red line in the chart above that the crowding score stayed low through most of 2020, even though the stock had a massive rally coming out of the Covid crash. This provided conviction to hold onto the position even as it rallied.

The current market sentiment around Apple is another excellent example, suggesting it might be more resilient than many expect due to its relatively low crowding score.

While Apple is no longer the mega-growth company it used to be, it has been a hated rally, with the stock showing falling levels of crowding despite the rally. This broadly aligns with our impression of the market where most funds have tended to be underweight Apple. Going forward, Apple could become more resilient than people expect because the positioning and the crowding are relatively light.

Looking Ahead

It is still important not to rely solely on one tool or indicator but instead consider the holistic view of the industry/market environment. We prefer aligning the VP Crowding Score with our quantitative Capital Cycle framework. The best contrarian investment opportunities are the least crowded names in a capital-scarce sector or the most loved names in a capital-abundant sector (link to VP’s Capital Cycle update from September 2022).

In Summary

By isolating and quantifying crowding, we can make more informed portfolio positioning decisions, reducing our human susceptibility to herd mentality.

Clients can access the VP crowding score here:

https://portal.variantperception.com/dashboards/vp-research/stock-idea-generator