TIPS for the long run

We like allocating towards TIPS at prevailing real yields. Given our structural Age of Scarcity thesis, we suspect a regime shift in the coming years where inflation realizes more than breakevens.

The below is an excerpt from our June 12th report to VP clients.

The latest market angst over Fed hikes in June/July have pushed US real yields up again towards post-GFC highs. The 5y US real yield is at +1.80% and the 10y US real yield is at +1.55%. We like allocations towards TIPS at these attractive prevailing real yields.

TIPS can offer upside in various cyclical macro scenarios:

A) Fed loses control of inflation, causing inflation to realize more than breakevens

B) Recession, in which case Fed will eventually cut rates, likely dragging down real yields

The main cyclical scenario in which TIPS could lose money from prevailing starting real yields is if real trend GDP growth surges higher, allowing the economy to tolerate a much higher real yield. The AI revolution may allow this, but given how weak Variant Perception's leading indicators are, we suspect this is not imminent.

Structurally, in the era of financial repression / Age of Scarcity, the large forthcoming debt issuance suggests the US government will not tolerate high real yields, and will work with the Fed (yield curve capping, analog to 1942-1951 Treasury-Fed Accord period) to manage borrowing costs.

The 2023Q1 Treasury Presentation to the Treasury Borrowing Advisory Committee (TBAC)(link) shows we should expect debt issuance of 1-1.5 trn USD per year for the foreseeable future.

The US treasury recently published their latest thinking on future TIPS issuance (link). The key quotes are in bold italics.

“TIPS Are a Natural Hedge for Treasury as Government Deficit Typically Rises During Periods When Inflation Falls.”

This statement reflects the automatic stabilizer of fiscal policy during downturns, but does not capture the regime shift in higher discretionary fiscal spending in the coming years. Fiscal spending will be inflationary for goods and serves as it directly impacts real economic activity, in contrast to QE which works more via portfolio rebalancing channels and asset price inflation.

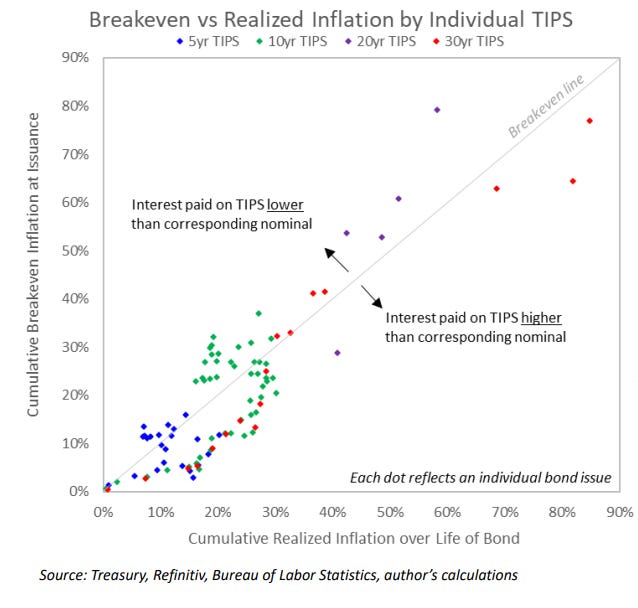

“We recommend larger TIPS auction sizes within framework of regular and predictable issuance… Historically, around 40% of TIPS issues have realized lower interest costs than nominal counterparts. The overall cost has been $80bln higher vs comparable nominal coupons.”

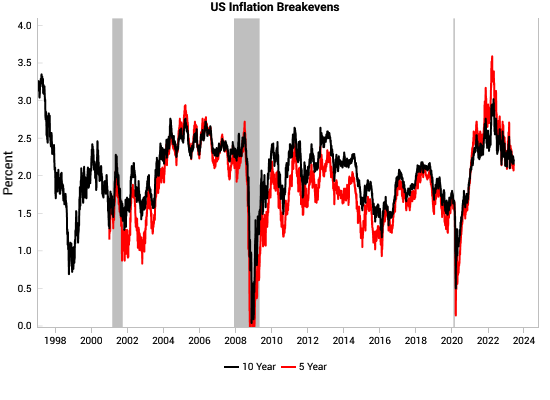

The TIPS market has only existed since 1997 during a disinflationary era. We are skeptical about extrapolating previous TIPS experiences into the future. The era of financial repression and fiscal and monetary policy coordination suggests inflation risks are biased to the upside when 5 year inflation breakevens are back down to 2.15% and 10 year inflation breakevens are back to 2.20%.

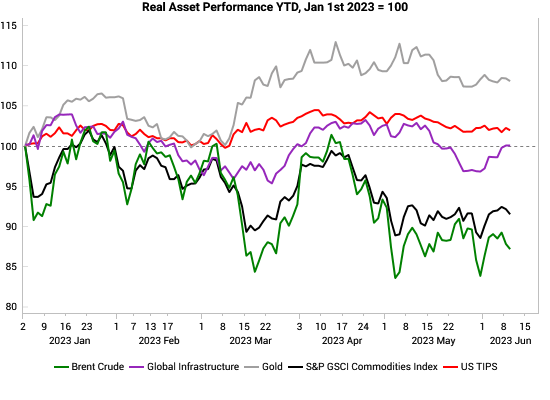

Over the past 6 months, gold prices have surged and diverged materially with real yields (left chart below). Historically, the two are very correlated. The main previous instance of such a divergence was in 2005-06 (right chart below), when the global growth cycle was much stronger than today.

Among “real assets”, gold is by far the outperformer YTD. We still think gold makes sense as an allocation, and now the value in TIPS is hard to ignore.

We don't write about TIPS very often, as the opportunity usually only becomes interesting at the extremes. We previously wrote about TIPS being very expensive and mispriced in August 2021 (link), which in hindsight was very good timing, as that coincided with the actual low in real yields.

We have also historically been wary of TIPS vs nominals heading into a recession, which we flagged in November 2022. We wrote: “TIPS underperform nominals as inflation breakevens fall. Additionally an illiquidity premium tends to get priced into TIPS around recessions.”

Today, we are less concerned about TIPS underperforming nominals as breakevens have grinded lower towards 2%.

We acknowledge that TIPS are prone to trading liquidity issues in times of stress, e.g. in March 2020 and through 2008. In the context of our broader asset allocation positioning (link) we rely on nominal Treasuries for upside as a recession scare gets priced in, and would look to sell and deploy excess cash into capital-scarce risk assets. We would look to hold onto TIPS through a downturn (and ride through trading liquidity issues) into the next cycle where inflation settles at a high level.

Get the full picture at variantperception.com