EM Equities: Top/Bottom Names by Crowding

This is a follow-up to the previous blog post on top/bottom crowding names in US equities. This time, we look at the Emerging Markets landscape.

For further reference on our approach to crowding, read the blog posts below:

By quantifying crowding, we can use the score to help with portfolio risk management or to highlight new investment opportunities. The most optimal way to utilize crowding is in the context of the capital cycle. Asymmetric investment opportunities arise from the least popular names within a capital-scarce industry.

Categorizing Most/Least Crowded Names

VP's Crowding Score uses unique and uncorrelated inputs to capture a range of investor behaviors and flag when a stock is most/least at risk from herd mentality.

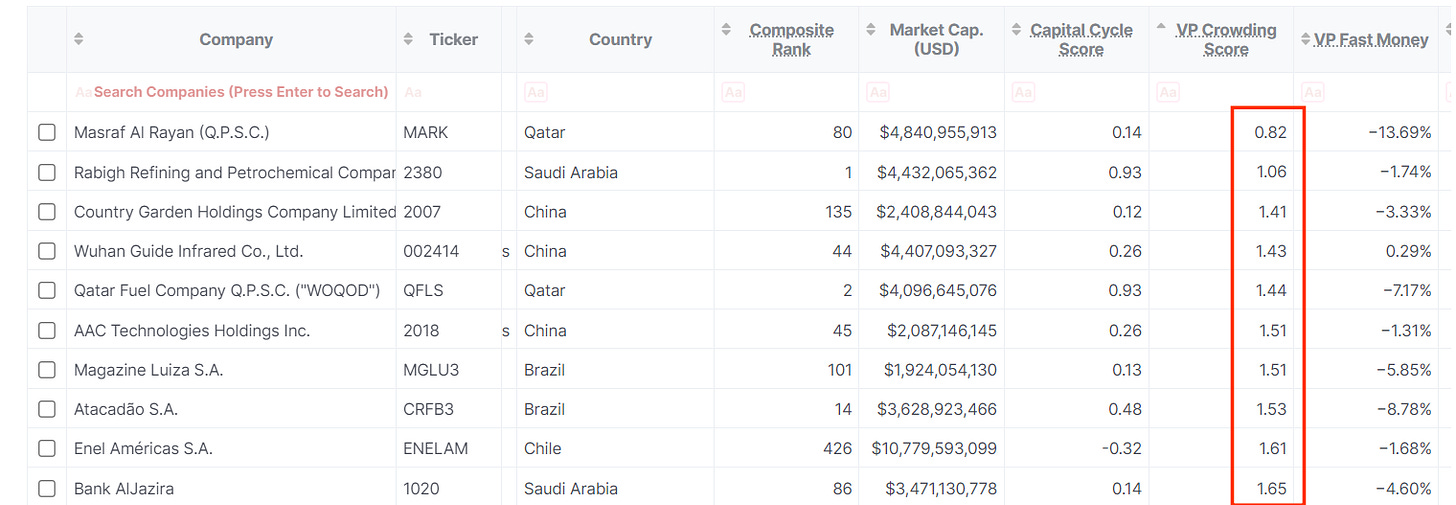

The following tables showcase crowding ranks on EM names as of Oct 27th.

Top 10 most crowded names:

MYTIL currently stands as the most crowded name. This implies that the stock is at risk of benefiting less from good news and is potentially more vulnerable to bad news.

Bottom 10 least crowded names:

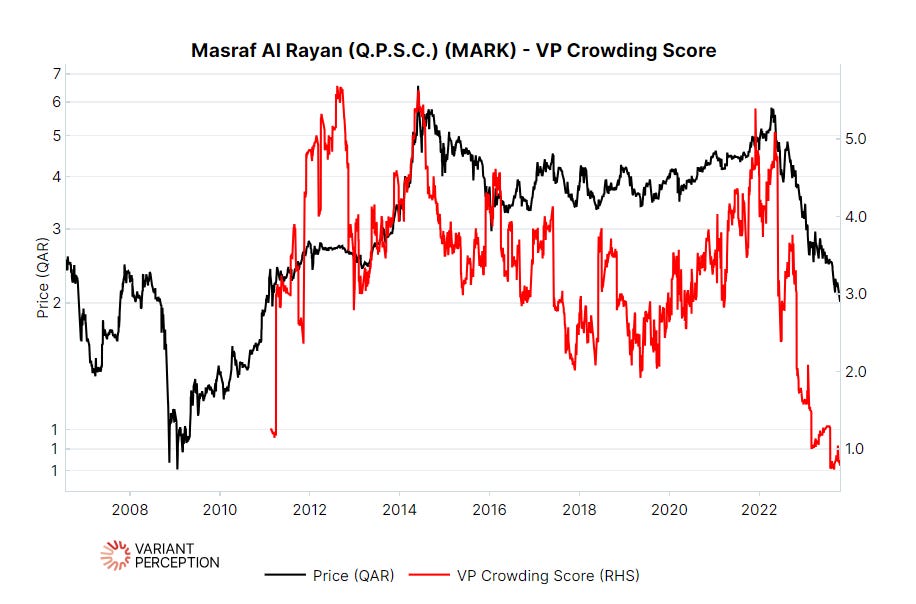

On the contrary, MARK shows the least crowding score. Out of all the historical data, it’s never been lower. This score suggests the stock may benefit more from good news and not get hurt as much by negative news vs its uncrowded counterparts.

VP Understanding Webinar - VP Crowding (Equities)

In this webinar, Tian Yang, Head of Research at Variant Perception, and Ian Mellen, Quantitative Analyst at Variant Perception, showcase some specific use cases.

Clients can access the VP crowding score here:

https://portal.variantperception.com/dashboards/vp-research/stock-idea-generator