The Age of Scarcity Part 3: The Capex Supercycle

An old asset base + large infrastructure spending gap + negative real financing costs (financial repression) = an incoming capex supercycle. This is the final part of our 3-part series based on the insights from our “Age of Scarcity” thematic report sent to VP clients in November 2022. See here for Part 1 and Part 2.

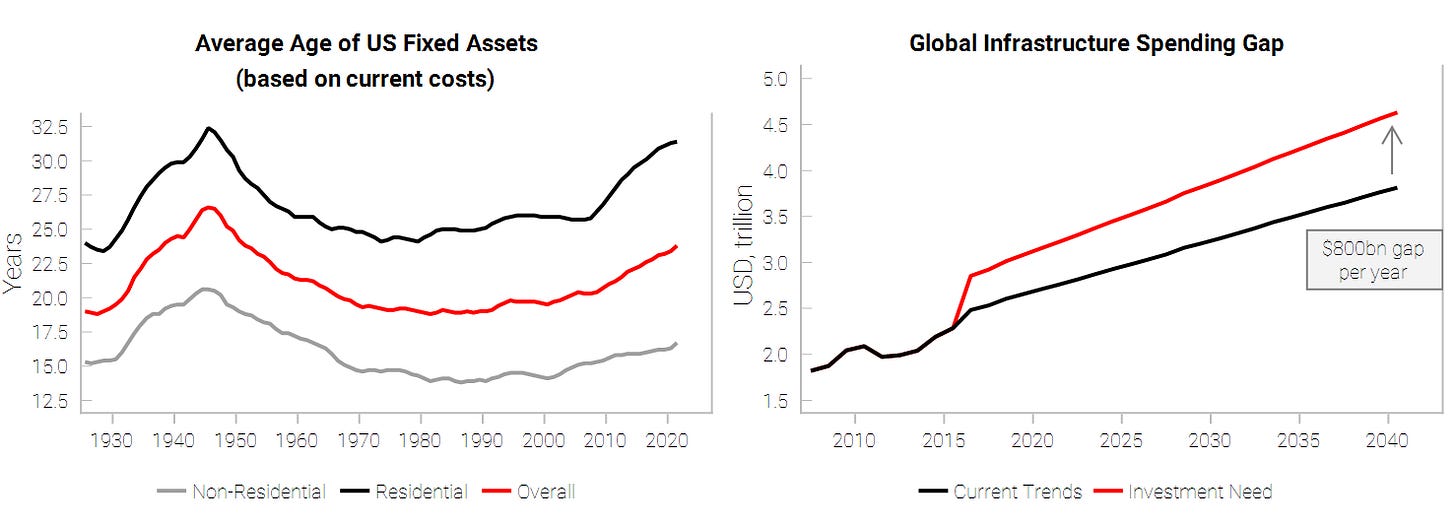

The US’s fixed asset base is extremely old. The last time it was this old was just after WWII, which preceded a huge capex reconstruction boom. The American Society of Civil Engineers has graded the US infrastructure as C-. The Global Infrastructure Hub estimates that the infrastructure spending gap is now at 800bn USD per year (right-hand chart). The surge in net-zero commitments will also necessitate plenty of investment and capex.

Is it finally “infrastructure week”? Minsky called it “managerial welfare-state capitalism”: big government + big business + big labor. Financial repression is usually needed to keep debt servicing costs low. There are lots of successful examples:

France’s Les Trente Glorieuses: 1945-75. Ministry of Finance promoted growth by steering domestic savings towards investment in PPE. Charles de Gaulle launched a second phase of industrial policy from mid-1960, rapid modernization in high tech sectors like electronics and telecoms.

East Asian Model: inspired by Japan, east Asian economies saw rapid development after WWII. Government intervention was critical: targeted and subsidized credit to selected industries, low deposit rates and ceilings on borrowing rates, subsidies to declining industries, the establishment and financial support of government banks.

US New Deal era: FDR entered office with enormous political capital. Creation of a middle class as well as the baby boom kept consumer demand high and fueled rapid spending on infrastructure.

Source: Federal Reserve, De Boree, Al Jazeera

During the New Deal era, capex-heavy stocks outperformed. (top left chart, we use the lifetime of the Reconstruction Finance Corp to define this period). Construction stocks boomed after the Federal-Aid Highway Act and were quite resilient through the 1957-58 recession.

Capex-heavy stocks have significantly underperformed over the last 10+ years (bottom chart from Goldman Sachs). Investors have much preferred asset-light businesses, financial engineering and buybacks.

Infrastructure is in the sweet spot of being a politically-favored industry and capital scarce, and is set to benefit greatly out of the next recession.

The Kalecki-Levy profits identity shows that private sector profits are boosted when governments run fiscal deficits. Changes in savings (usually driven by counter-cyclical government policies) lead future profits growth:

Government Budget Balance + Household Sector Balance + Current Account Balance = Financial Profits

Infrastructure fund raising has been extremely strong in 2022 despite the bear market ($90bn raised in 1H22 in US. This is 21% of all private market fundraising vs 8% long-term average, source: Preqin).

Unlisted infrastructure funds are taking a lot of public infrastructure companies off the market (bottom-left chart).

The surge in infrastructure dry powder will intensify the demand-supply mismatch: expect higher take-private deal multiples as the listed universe shrinks. This has already happened in the Australian listed market. There are just a small handful of pure listed infrastructure companies left after a surge in take-private deals over the last 2 years.

Do not forget about the importance of the business cycle. Liquidity leading indicators lead global listed infrastructure returns (top chart).

All of VP’s cyclical indicators point risk-off on a 6-month horizon, so global listed infrastructure will likely offer little diversification benefit from equities (bottom-left chart).

Listed infrastructure typically trades at a premium relative to equities because of their more predictable cash flows (bottom right chart). Today EV/EBITDA multiples are at the top of their historical range.

The solution: find capital-scarce and government-aligned infrastructure companies. These companies are most likely to outperform after the business cycle downturn.

Upstream industries offer a more levered way to play the capex supercycle. Infrastructure assets offer investors inflation-linked exposure with an upside takeover / valuation catalyst.

Get the full picture at variantperception.com